|

||||||||

|

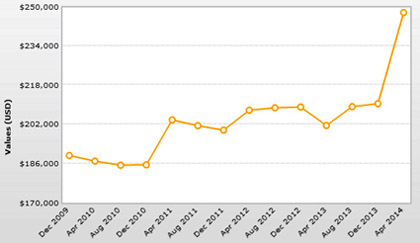

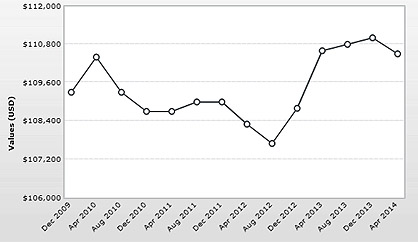

CURRENT TRENDS Obviously the current trend for just about any collectible classic automobile is rising and has been very steadily for the last 5 years in all categories. Most doubted this would happen after the financial meltdown in late 2008. But the opposite happened. In fact most were anticipating the opposite would occur. So there are few questions here to answer. As a professionally trained economist (holds degrees in Economics ) this has been particularly interesting to me. We have seen many market booms and busts over the last several years in terms of Internet IPOs and real-estate markets. So the question what makes this market unique? Well for starters it is a combination of things. Most of the players in this current market are somewhat unlike the collectors I would see in the past. Overall I do not see overly optimistic speculation. I see older retired men with some excess cash that they would rather put into a classic car purchase as opposed to risk it in the stock market or put in a zero interest earning savings account. Many of these buyers I see at the auctions are buying some dream from their past. Since practically all these purchases are cash based it supports the theory that there is no immediate market correction to come. If we do look closely at the numbers we can see that the Blue Chip cars are moving up at a pace similar to that of fine art and super expensive real-estate. Obviously these buyers have so much wealth that they are hardly influenced by anything other than desire. The same can be said for much of the recent very high end vintage Ferrari. The segment of the market that has surprised me most however is the very high demand for the early Porsche 911 cars. It has literally skyrocketed in the recent year. As you can see from the graph on the right Muscle cars have made a comeback in the last year. Although their prices were never really down they were very flat up until recently. However from my observation this is mostly influenced by some very rare numbers matching original nearly one of a kind unique high horsepower cars. It is my belief that more ordinary muscle car prices remain relatively flat but are holding up as more and more sellers appear to be constantly unloading collections at auctions. We do see more ups and downs in pricing over the last few years on the classic 1950's American cars. This also appears to be true what Hagerty calls the affordable classics. These markets appear to be a little more unstable than the high end as more and more of the less wealthy collectors are trading in and out of the market more often as their preferences change. They tend to only have one or two collector cars compared to the wealthy collectors large array of various vehicles. Although it is impossible to accurately predict the future, I personally feel there may be some slight to significant corrections in the overall collectible and classic car market as interest rates go up. I think there will be some investors selling off to take advantage of getting a higher and higher return on their money in the future if interest rates on term savings accounts increase drastically. My other theory is that as many of the current collectors age their heirs and beneficiaries will be less likely to want to hold and maintain the cost of these collections. But that is more of a long term theory. In summary it seems at least for the near future quality classic automobiles will more than likely continue to rise in value in pace with any other similar investment. Obviously certain vehicles may become less or more popular just as they always have. Still it makes since to watch the auctions and get a feel of where the market is moving. |

||||||||

|

|

|||||||

Examples of 1950's American

Collector Cars

|

||||||||